Week 4

The Hundred Days of January.

I made it through the 100 days of January—LOL! That’s certainly what it felt like.

JFAC Committee:

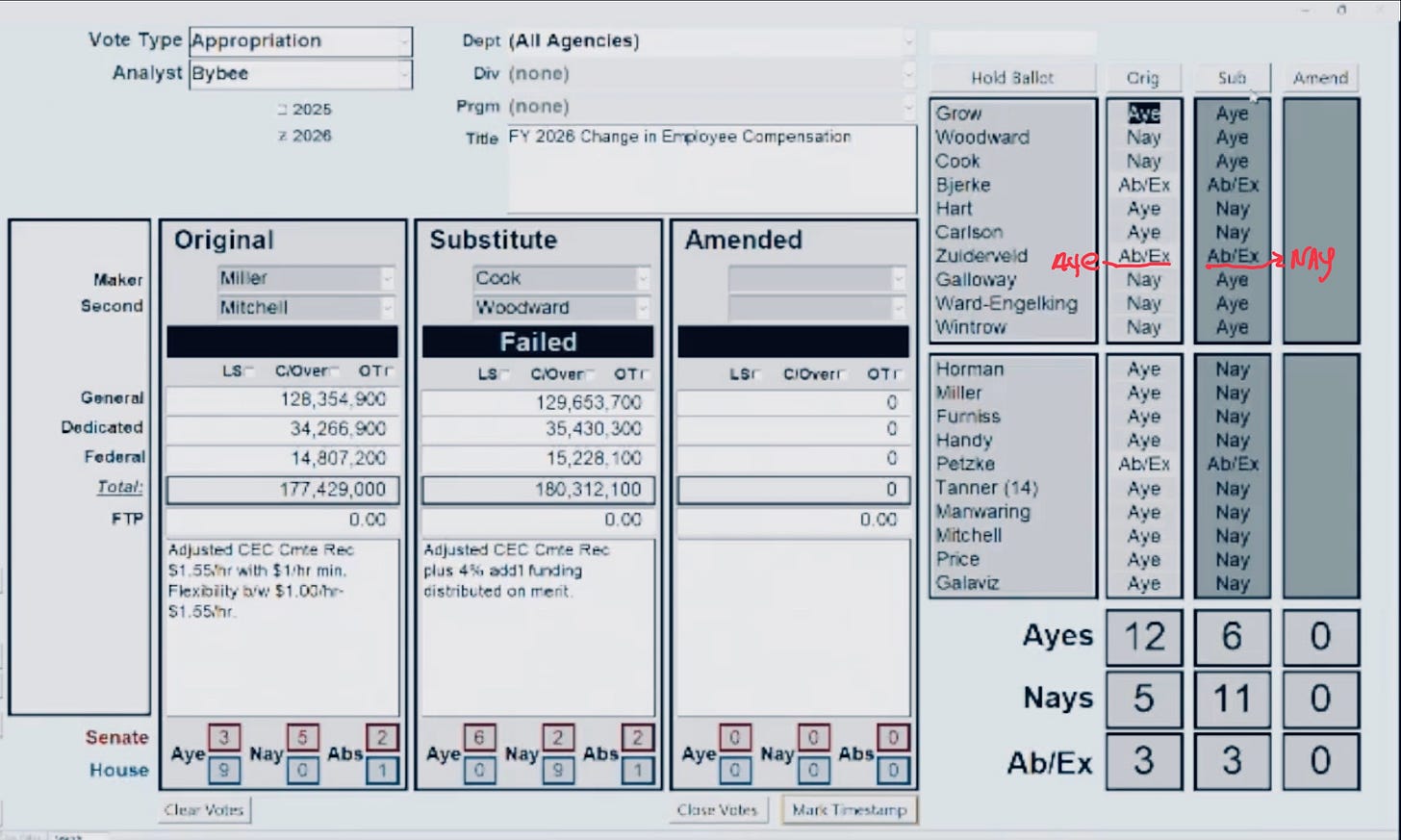

We have yet to make a decision on the Change in Employment Compensation (CEC). Until this is resolved, we cannot move forward with any other budget enhancements.

The motions presented have been either a $1.55 an hour increase across the board or whichever is higher between $1.55 and 4%. A total of four motions were proposed, but none passed.

If you’d like to hear the motions and discussions, clickHERE.

I was absent due to exhaustion, which left me feeling under the weather. Below is a screenshot of the vote, along with how I would have voted if I had been present.

Health and Welfare:

We are reviewing gubernatorial appointments, listening to presentations, and voting on Routing Slips to assign bill numbers.

At this time, I can say that Health & Welfare has been relatively free of emotional drama—which I’m truly thankful for!

Other Updates:

Here are some short videos to give you more updates and a different perspectives.

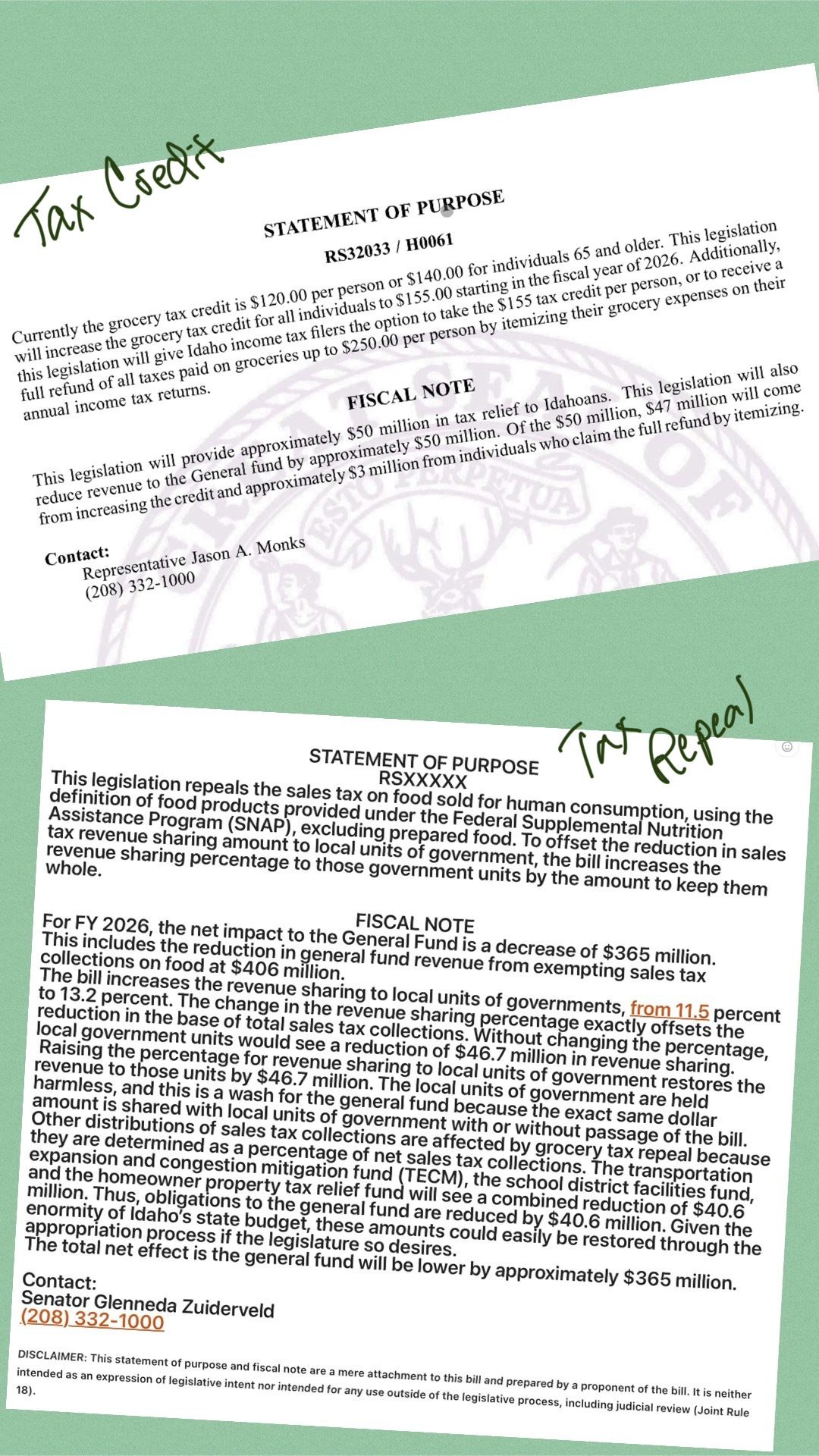

Grocery Tax Repeal vs. Grocery Tax Credit:

What’s the Difference Between the Two?

Here’s a simple breakdown of the bills:

The repeal would provide immediate relief at the register, eliminating the sales tax on groceries outright.

The tax credit: Here’s what that really means:

The tax credit would increase to $155 per person—which is just $35 more per person (or $15 more for individuals over 65).

Alternatively, you could save all your grocery receipts for a year, itemize them on your taxes, and receive an additional $95 per person.

However, you would need to identify what qualifies as "food" in order to calculate the tax properly—essentially turning every Idahoan into a bookkeeper for breadcrumbs.

And to top it all off, none of this would take effect until 2026, meaning you wouldn’t receive your credit until 2027.

Is it right to force Idaho citizens to beg for their money back by proving what groceries they bought? I say no—it's time we fight for our citizens instead of the government and provide them immediate relief at the register.

While the tax credit bill has been assigned a number in the House Chambers, the repeal was handed to Chairman Cannon for consideration. However, he refused to commit to a hearing. We are now hoping to have it heard in the Senate Tax & Revenue Committee.

One challenge we face is that tax bills are traditionally introduced in the House Chambers. However, we are challenging that precedent, as this bill does not add a tax—it removes one. I remain hopeful that the political games surrounding this issue will end and that we can come together to provide real relief to hardworking Idahoans on the essential items they need to survive.

Click HERE to read the H61 tax credit. I would share a link to the repeal, but since it has not been assigned a bill number, no link is available at this time.

Additional sponsors of the repeal, who have been added to the Statement of Purpose but are not reflected in the picture, include Senator Josh Kohl and Representatives David Leavitt and Lucas Cayler.

Lastly, I want to humbly acknowledge a mistake I made in my last email regarding the appropriations for the Mobile Museum. Many of you pointed out my error, and I sincerely appreciate your feedback. I have since removed the comment, but I recognize that many of you saw it before I did so.

I ask for your grace and understanding as I continue to navigate my role on the Appropriations Committee and learn through this process.

Many ask why I include songs, quotes, and Bible verses in my emails. The reason is simple—it offers you a deeper insight into my heart, mind, and personality.

I believe it's important to show vulnerability by sharing personal thoughts and the things that inspire me. It also helps lighten the heaviness of politics, providing a small but meaningful distraction from the drama, even if just for a moment.

Music brings joy, quotes remind us of history, and Bible verses offer hope.

Quote of the week:

Song of the week:

Bible Verse of the week:

Prayer:

About the tax credit: How would 250.00 suppose to satisfy me and make me happy when the grocery tax that I am end up paying per year is more than that amount? It feels almost like I am being compensated with a lollipop for being a good citizen by sacrificing my hard earned money just so the politicians pockets keeps inflating.

Thanks for your hard work! Taxing groceries is an immoral and greedy thing for a government to do. Tax repeal is the right way to go.