Week 3

Let’s cut the fat, and repeal the grocery tax.

Where to begin?

In JFAC, we are diving into the budgets, listening to analysts as they present the needs and wants of each agency to the committee, as well as hearing directly from agency directors. While many agencies are proposing some cuts to their budgets—which is a positive step—could they do more? And more importantly, could we, as your elected officials, do better?

I will share a few insights and let you form your own opinions.

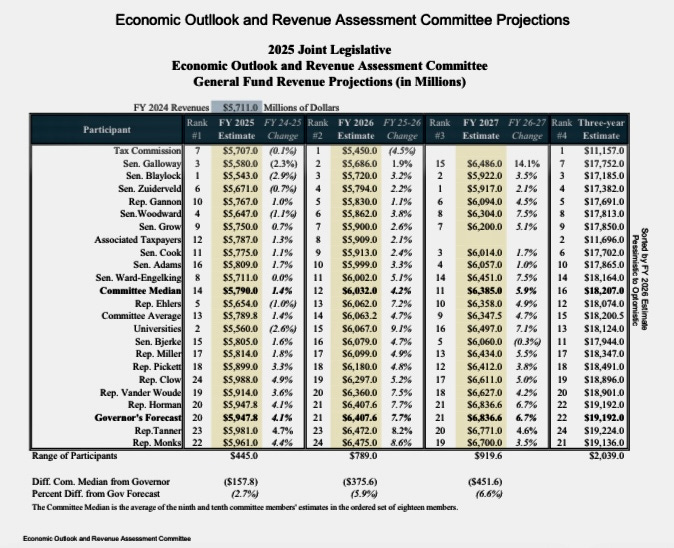

Let’s start with our state revenue. I want to emphasize that the DFM(Department of Finance Management) revenue figure is merely a projection. This year, I served on the Economic Outlook Committee, where we listened to numerous economists present their forecasts for state revenue and explained the rationale behind their projections.

We were told that Idaho’s economy is strong, but there are concerns about a potential recession, particularly if the President enacts tariffs or initiates mass deportations. Afterward, we were tasked with projecting a revenue figure to base the 2025 and 2026 budgets on.

My forecast came in just below the Tax Commission’s projection. The highest projections came from Rep. Tanner and Rep. Monks. Ultimately, we voted on a $5.93 billion revenue forecast.

What concerns me, however, is that we are setting budgets and offering tax relief based on a projected number. What happens if the projection is significantly off and we don’t bring in as much revenue as anticipated

?

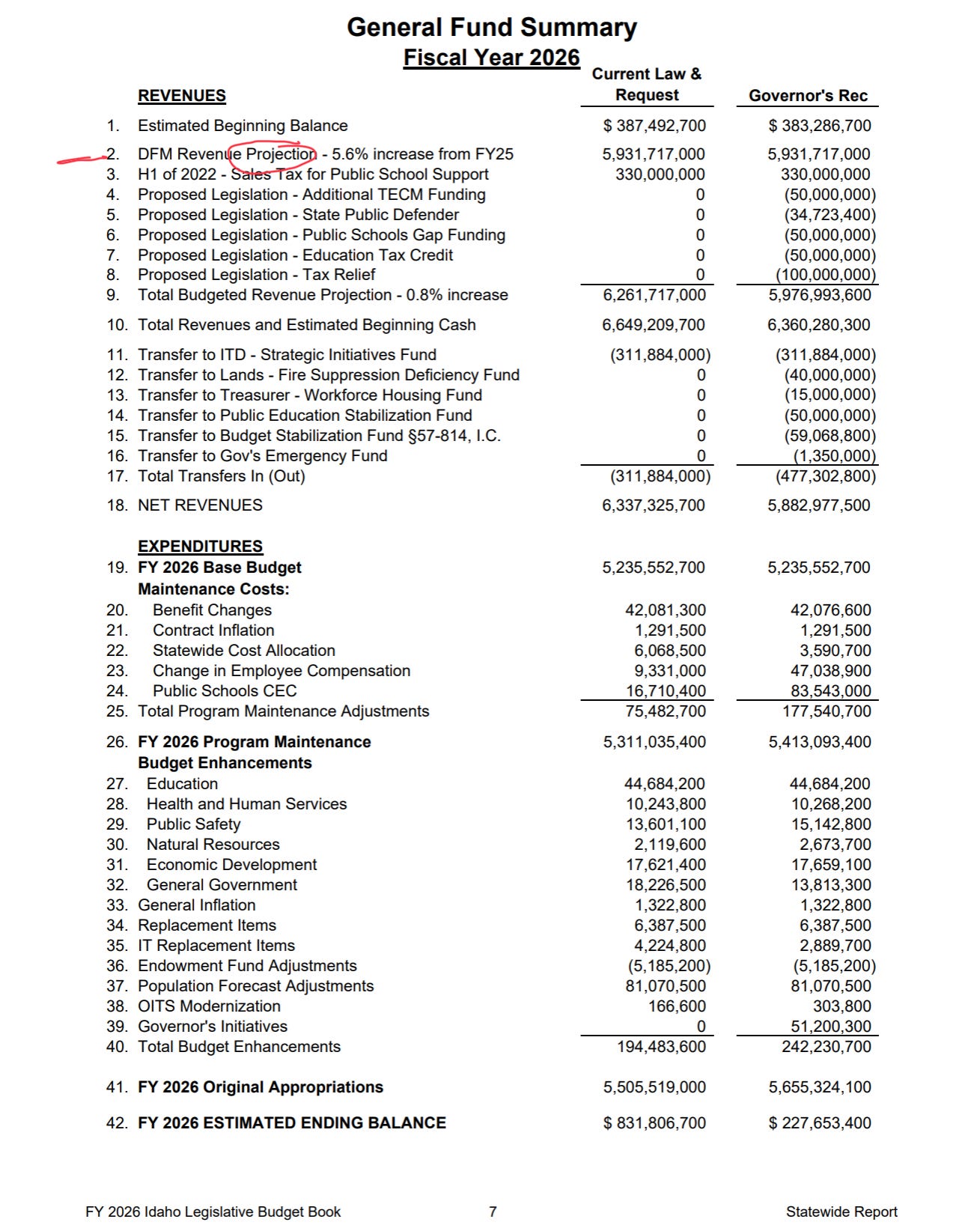

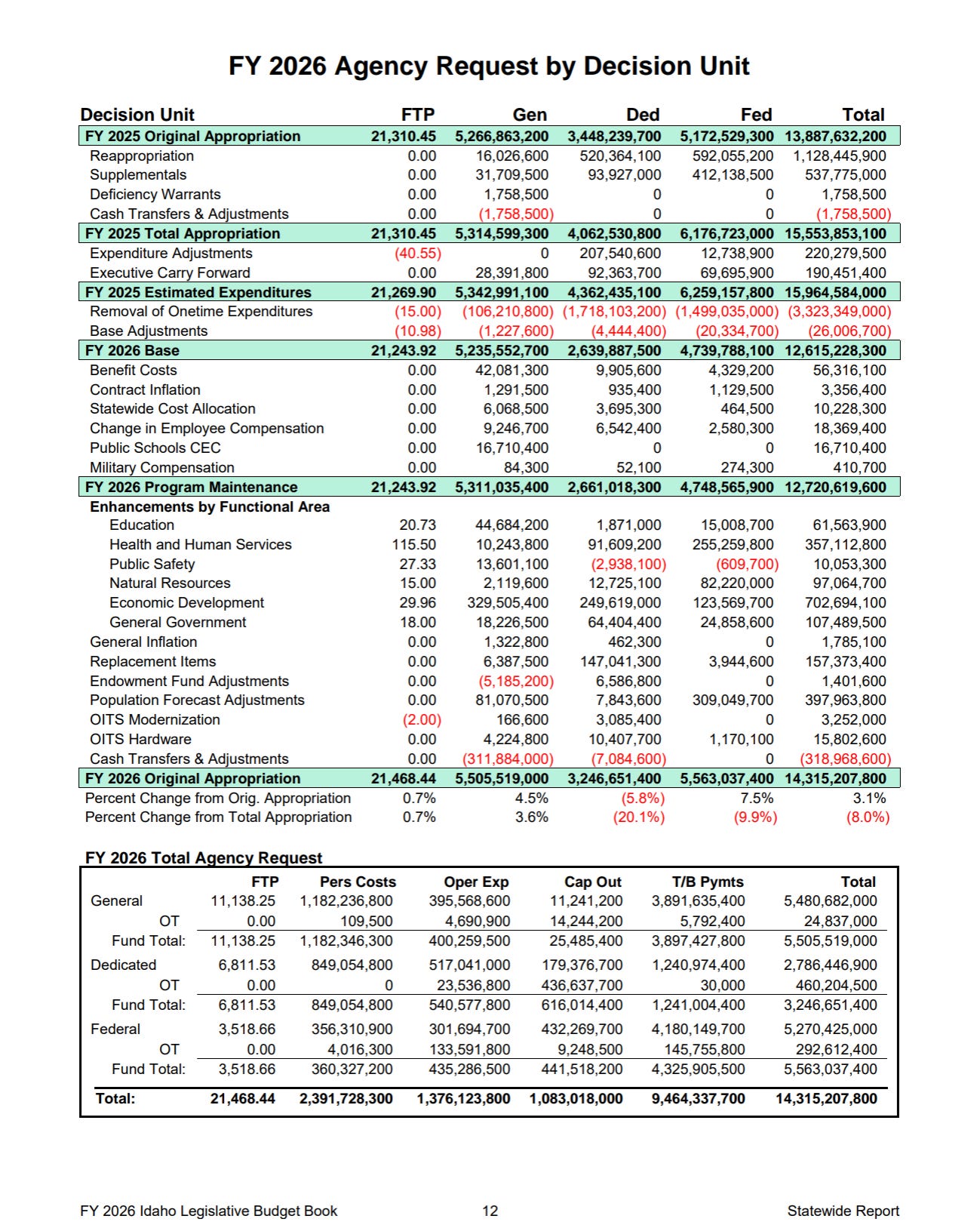

Next, let’s discuss agency requests. It appears the total budget is set to increase once again, from $13.9 billion to $14.3 billion, unless your legislators find the courage to say no to some of these requests.

I want to draw your attention to the FTP (Full-Time Positions) column. The Idaho state government currently employs 21,468 people. In my opinion, this is where much of the resistance to making meaningful cuts originates. I understand—people want to protect their jobs, as we all do.

However, consider this: if we implement cuts or forgo raises, these employees represent a significant portion of the voter base. Double that number, because most of them are married. Add to that the many individuals reliant on government welfare, and you have another substantial group of voters.

Let’s be honest—politics often revolves around re-election. And here we are, expanding government and increasing the budget yet again.

How can we honestly offer any form of tax relief while continuing to grow our budget? Are we relying on overly optimistic revenue projections and providing relief based on numbers that may never materialize? This is why I am doing everything I can to bring real, immediate relief—starting with the repeal of the grocery tax. You would see those savings at the register every time you buy essentials like eggs and milk.

Does this mean I’m against reducing income tax or property tax? Absolutely not. I would love to see your legislators eliminate wasteful spending so we can give true tax relief. Let’s reduce all taxes by cutting the fat from our budget. We need to focus on saying no to unnecessary wants and approving only genuine needs. This approach is prudent, especially given that experts are warning of a likely recession.

I did a interview with Idaho Dispatch Greg Pruitt, you can listen click HERE.

I also was part of Capitol Clarity with Senator Josh Kohl and Senator Christy Zito discussing grocery tax repeal, click HERE

“To compel a man to subsidize with his taxes the propagation of ideas which he disbelieves and abhors is sinful and tyrannical”.

~Thomas Jefferson

“Whoever loves money never has enough; whoever loves wealth is never satisfied with their income. This too is meaningless.” Ecclesiastes 5:10

Song Pick and fun fact: Peter Garrett lead singer from Midnight Oil is not only an Australian musician, but an environmentalist, activist and former politician.

I'm a simple man with simple thoughts. Why can't we budget Idaho's government based on last year's income instead of some "projection" which is simply a guess? Then, if revenue increases, bank it in a "rainy day" fund.

Sen. Zuiderveld, we’re so happy you’re doing this very dirty and thankless (not to mention boring for most) job of scrutinizing Idaho’s budget. Yours is a heavy lift, and we greatly appreciate what you are doing.

Let’s simplify all of this. Let’s ask JFAC to go over every department’s budget, line by line. Ask the questions:

1. Is this the proper role of government?

2. Is this mandated by Idaho’s constitution?

3. Is this mandated by Idaho’s current laws?

4. Is this funded by federal money?

If the answer is NO to #1 or #2 above, the line item goes away — poof 💨 — problem solved, money saved.

If the answer is NO to #1 and #2 but YES to #3, we may need to consider changing the Idaho laws.

And if the answer is YES to #4, we need to give the federal dollars back and say “Thanks, but no thanks.” Why should Missouri taxpayers pay for Idaho’s Medicaid recipients (for example)?

Once we’ve gotten rid of the unwarranted items, and only then, should any budget requests proceed. It shouldn’t matter whether we’re in good times or bad. If government is not operating within its lane, it needs to get back into line. (Yes, many people will cry about lost government jobs and programs, but this cost cutting must be done for the future of ALL people in our state.)

BTW — If people haven’t watched your interview with Greg Pruett yet, I highly recommend it.